does cash app report personal accounts to irs

For instance a husband and wife could each give 16000 to their child but they would need to report the 32000 to the IRS on Form 709 to properly split the gift between them. Assistive technology and personal support services health prevention and wellness financial management and administrative services legal fees expenses for oversight and monitoring funeral and burial expenses.

Cash App Flips Don T Be Fooled By Promises Of Free Money Verified Org

NW IR-6526 Washington DC 20224.

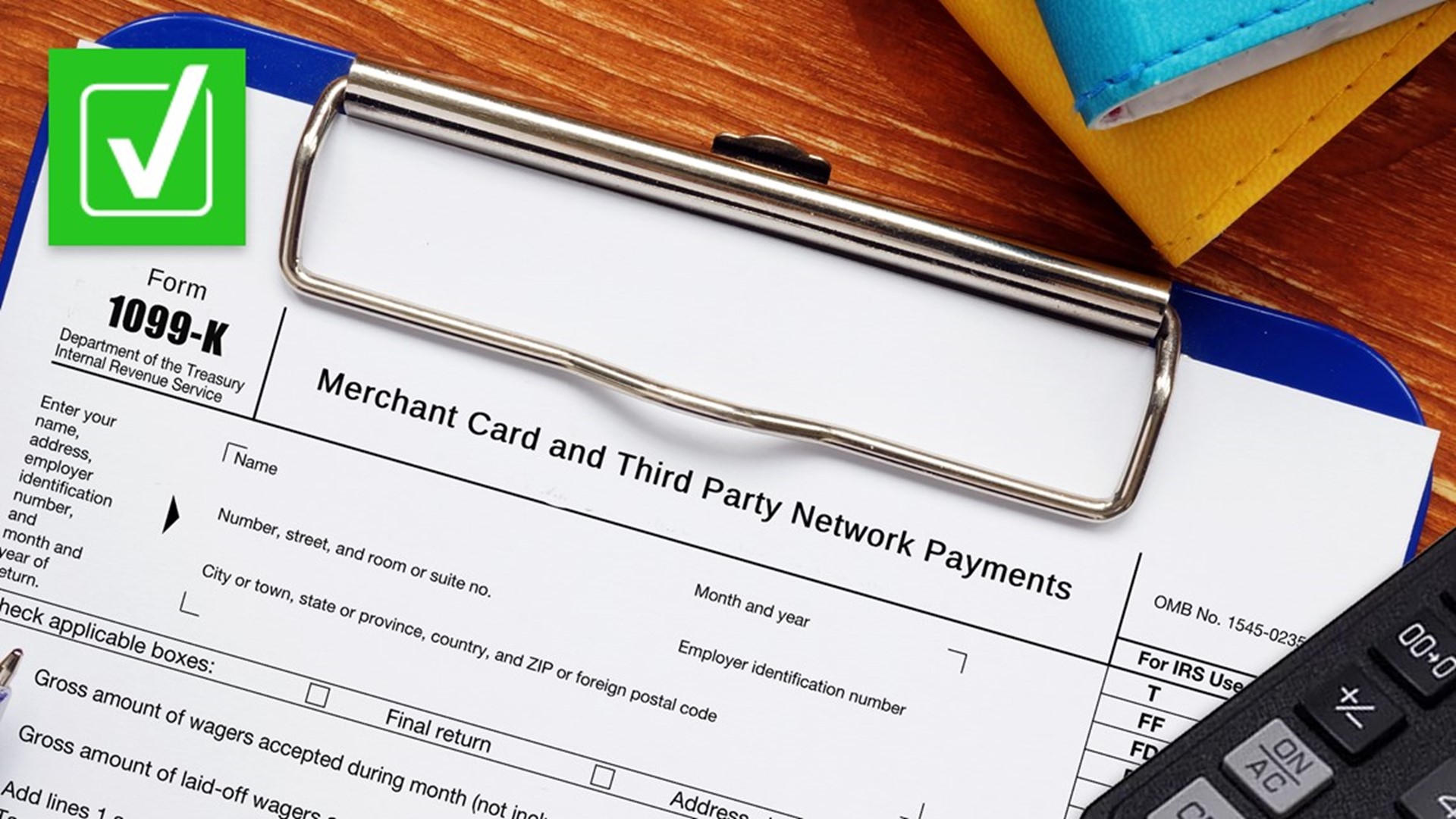

. According to IRS Publication 17 Federal Income Tax Guide for Individuals taxpayers must report this income as self-employment activity and the eFile Tax App will report this on the 1040 form on line 8z or on Schedule C of the tax return. EXECUTIVE SUMMARY THE IRS RELEASED REVENUE PROCEDURE 2000-22 and revenue procedure 2001-10 to give small businesses some much needed guidance on choosing or changing their accounting method for tax purposes. The new reporting requirement only applies to sellers of goods and services not.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Retail Online Banking users have access to deposit accounts loans and lines of credit. That means you might pay capital gains.

You might receive this tax form from your bank because. NW IR-6526 Washington DC 20224. Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes.

The 1099-INT is a common type of IRS Form 1099 which is a record that an entity or person not your employer gave or paid you money. Form 1099-QA Distributions from ABLE Accounts is used to report distributions from an ABLE Account. REVENUE PROCEDURE 2000-22 ALLOWS ANY COMPANY sole proprietorship partnership S or C corporationthat meets the sales.

Comments and suggestions. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Business users can access deposit accounts and overdraft lines of credit.

Cashback Debit details from Discover. We welcome your comments about this publication and suggestions for future editions. As well as stolen.

The Internal Revenue Service IRS treats all cryptocurrency like Bitcoin and Etherium as capital assets and taxes them when theyre sold at a profit. WhatsApp widely rolls out new privacy control settings to give users more control over who can see their Profile Photo About Last Seen and Status WhatsApp is rolling out new privacy control settings to provide users greater control over who can see their profile photo About Last seen and WhatsApp Status. ATM transactions the purchase of money orders or other cash equivalents cash over portions of point-of-sale transactions peer-to-peer P2P payments.

Cash App Taxes is for people with relatively simple tax returns who only need to file a federal and one state return. Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms instructions and publications. While Cash App Taxes covers many tax forms and situations it.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. They can also request that other business or personal accounts on which they have an. This also includes money or income from push money kickbacks side commissions etc.

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Changes To Cash App Reporting Threshold Paypal Venmo More

Cash App Taxes Review Free Straightforward Preparation Service

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Understanding Your Cash App 1099 K Form Updated 600 Tax Law

Everything To Know About Venmo Cash App And Zelle Money

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

How Does The Irs Law Work On 600 Payments Through Apps Marca

Cash App Tax Forms All Tax Reporting Information With Cash App

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates